Tax Deductions For Rental Property 2024

Tax Deductions For Rental Property 2024. Learn the different rental property tax deductions in 2024 for your rental property to ensure you can maximize your return on investment! Tax deductions for rental property.

If you are paying off a mortgage on your rental property, you can deduct the interest on that loan. Expenses may be deducted for items such as normal.

However, This Increased Business Income Can Mean A Higher Tax Bill Come Tax Time.

Tax deductions for rental property depreciation.

If You Are Paying Off A Mortgage On Your Rental Property, You Can Deduct The Interest On That Loan.

Owning a rental property can generate some extra income, but it can also generate some great tax deductions.

Rental Property Tax Deductions Offer Significant Financial Benefits To Real Estate Investors.

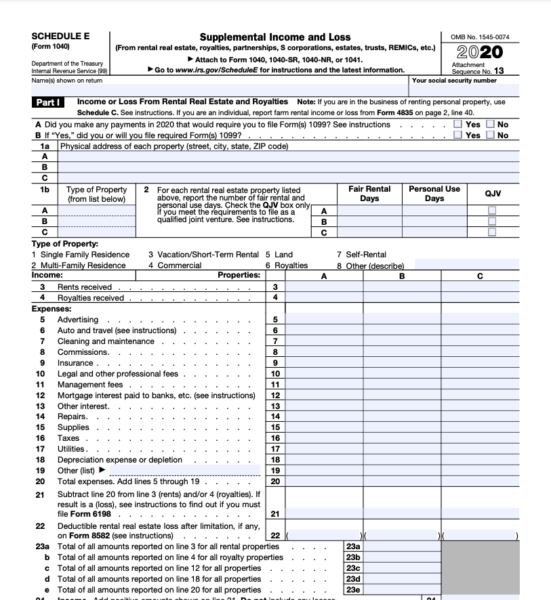

Images References :

Source: www.credible.com

Source: www.credible.com

Rental Property Tax Deductions A Comprehensive Guide Credible, Some deductions available under the old. Creative content writer at liv.rent.

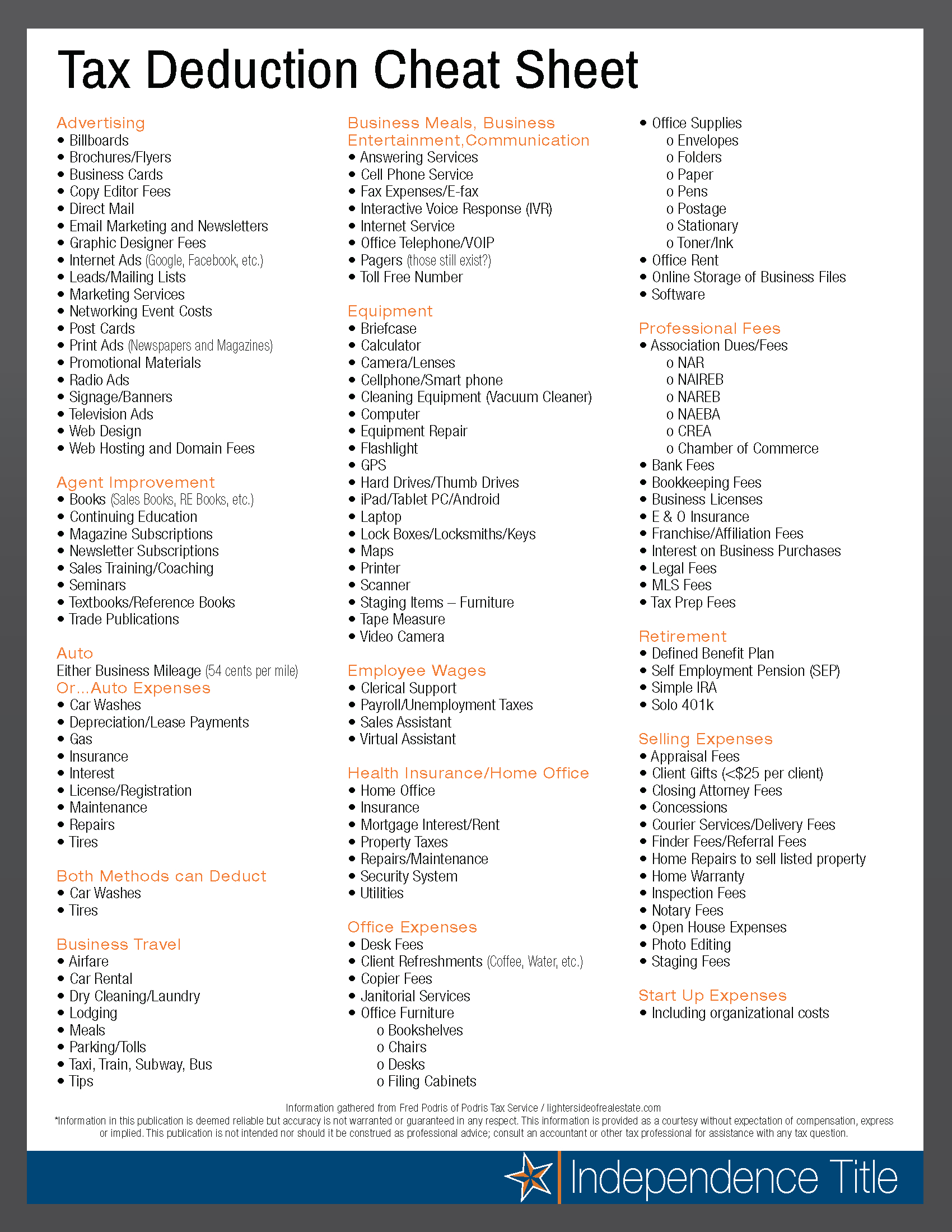

Source: db-excel.com

Source: db-excel.com

Tax Deduction Cheat Sheet For Real Estate Agents —, However, this increased business income can mean a higher tax bill come tax time. The new tax regime is the default choice unless one intends to go back and avail of the benefits under the old tax regime.

Source: americanlandlord.com

Source: americanlandlord.com

Top 10 Landlord Tax Deductions for Rental Property American Landlord, When calculating your taxable rental income, start by adding up all the rent you collected. The benefit of tax exemption on expenses incurred on the purchase or transfer of property like stamp duty and registration fees can be availed only on residential.

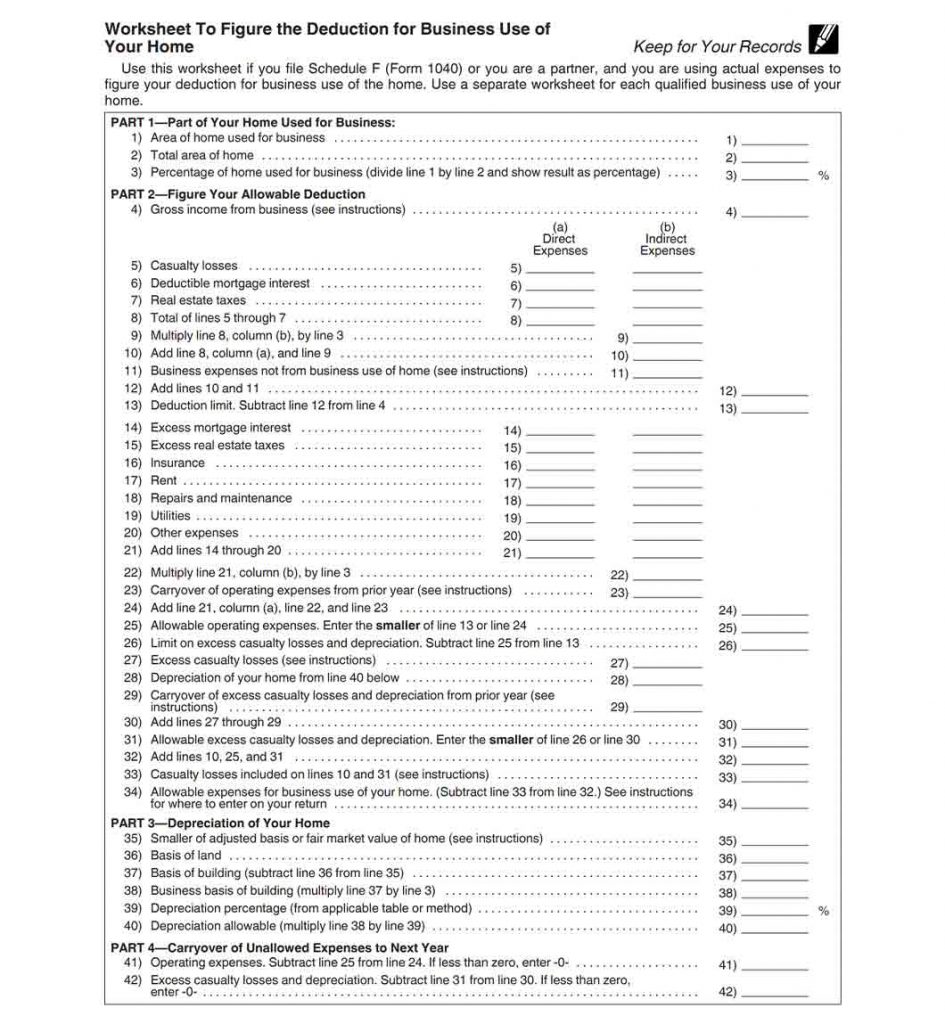

Source: accidentalrental.com

Source: accidentalrental.com

5 Most Overlooked Rental Property Tax Deductions, Owning a rental property can generate some extra income, but it can also generate some great tax deductions. This limit is reduced by the amount by which.

![Rental Property Deductions Checklist [Top 25 Deductions]](https://learn.roofstock.com/hubfs/rental tax deductions.jpg) Source: learn.roofstock.com

Source: learn.roofstock.com

Rental Property Deductions Checklist [Top 25 Deductions], Norms for rental income deductions. Rental property tax deductions 1.

Source: www.fastcapital360.com

Source: www.fastcapital360.com

Home Office Tax Deduction What to Know Fast Capital 360®, The nine most common rental property tax deductions are: The updated rules could either increase or decrease the amount of depreciation that owners can claim, thus.

Source: www.signnow.com

Source: www.signnow.com

Realtor Tax Deductions Worksheet Complete with ease airSlate SignNow, Published on 04 january 2024. Most homeowners use a mortgage to purchase their own home, and the same.

Source: www.mlllp.ca

Source: www.mlllp.ca

Rental Property Tax Deductions in Canada (2024) MLLLP, Some deductions available under the old. Click here to explore the table of contents.

Source: americanlandlord.com

Source: americanlandlord.com

Rental Property Tax Deductions American Landlord, Here are five big ones that tax. Most homeowners use a mortgage to purchase their own home, and the same.

Source: mccawpropertymanagement.com

Source: mccawpropertymanagement.com

What Tax Deductions Are Associated With Owning Fort Worth Rental Property, The updated rules could either increase or decrease the amount of depreciation that owners can claim, thus. Most homeowners use a mortgage to purchase their own home, and the same.

Rental Property Tax Deductions Offer Significant Financial Benefits To Real Estate Investors.

Creative content writer at liv.rent.

How To Calculate Taxable Rental Income?

The nine most common rental property tax deductions are: