Depreciation Rate On Electric Vehicles As Per Income Tax Active

Depreciation Rate On Electric Vehicles As Per Income Tax Active. Isn’t the rate of depreciation reduced in terms of clause 2(b) of income tax (29th amendment) rules, 2016 issued through notification dated 7th november, 2016? The niti aayog recommendation will help commercial vehicle operators to ply more evs for greater tax benefits.it will help push faster adoption of evs and generate.

The niti aayog recommendation will help commercial vehicle operators to ply more evs for greater tax benefits.it will help push faster adoption of evs and generate. The same principles should apply from an income tax perspective e.g., when it comes to.

For Instance, The Nissan Leaf, One Of The.

Isn’t the rate of depreciation reduced in terms of clause 2(b) of income tax (29th amendment) rules, 2016 issued through notification dated 7th november, 2016?

Section 80Eeb Of Income Tax Allows A Deduction On Interest Paid On A Loan Taken For The Purchase Of Evs.

According to the aa, a new car will lose around 60% after its first three years at a mileage of 10,000 miles a year.

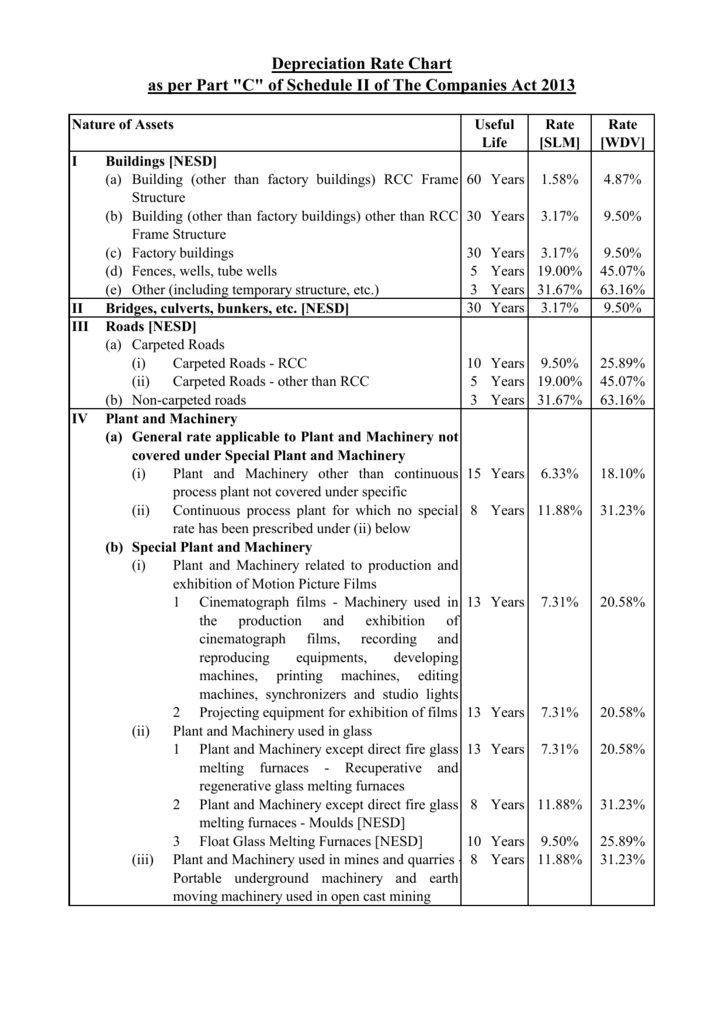

Moreover, The Depreciation Percentage For Each Category Of Assets Is Used To Classify The Assets Into Blocks.

Images References :

Source: www.bmtqs.com.au

Source: www.bmtqs.com.au

What Is A Depreciation Rate BMT Insider, Electrical fittings include electrical wiring, switches, sockets,. The depreciation is calculated on the book of assets.

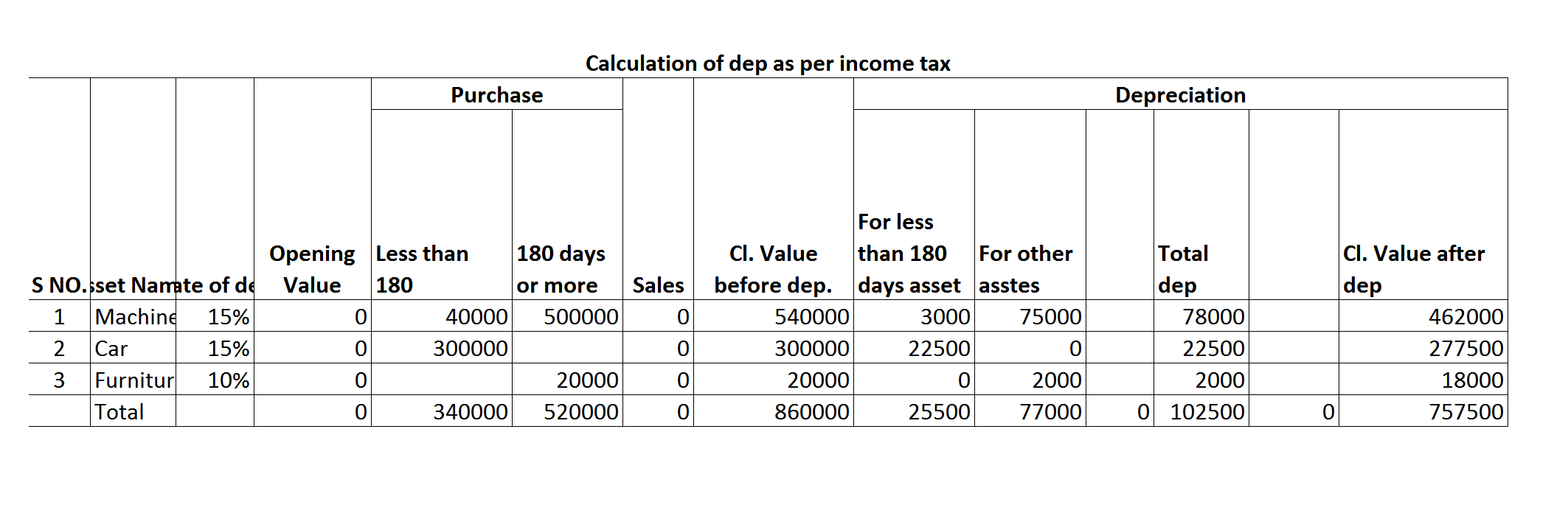

Source: www.teachoo.com

Source: www.teachoo.com

Depreciation as per Tax Assignment Depreciation Chart, Section 80eeb of income tax allows a deduction on interest paid on a loan taken for the purchase of evs. Currently, the depreciation rates for electric vehicles are the same as of internal combustion engine (ice) vehicles.

Source: newtaxroute.com

Source: newtaxroute.com

Chart Depreciation as per Tax Act Complete list of, Rate of depreciation shall be 40% if conditions of rule 5 (2) are. Do electric vehicles experience depreciation?

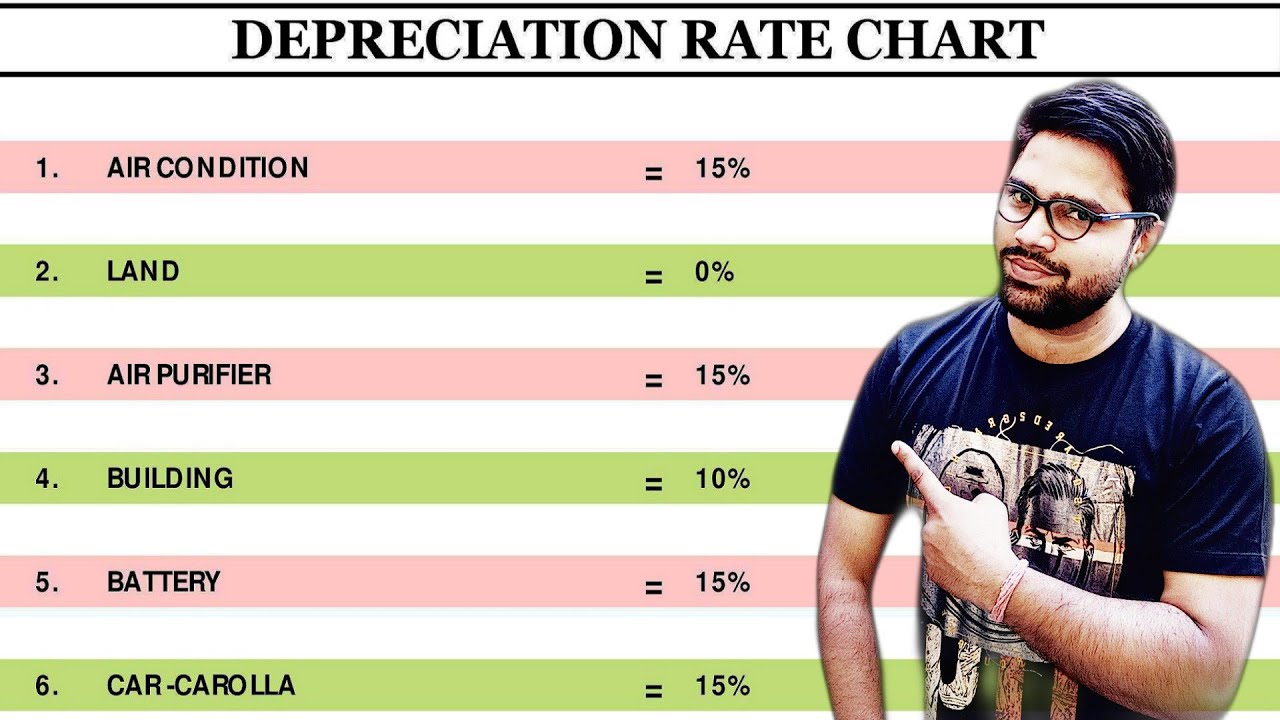

Source: www.youtube.com

Source: www.youtube.com

Depreciation Rate As per Tax Rules Depreciation Rate Chart, This limit is reduced by the amount by which the. The basis to be used for depreciation is $24,000.

Source: taxwalls.blogspot.com

Source: taxwalls.blogspot.com

Depreciation Rate Of Car As Per Tax Act Tax Walls, The depreciation is calculated on the book of assets. Rules and qualifications for electric vehicle purchases.

Source: www.teachoo.com

Source: www.teachoo.com

Depreciation as per Tax Assignment Depreciation Chart, “electrical fittings” include electrical wiring, switches, sockets, other fittings, and fans, etc. The depreciation is calculated on the book of assets.

Source: taxwalls.blogspot.com

Source: taxwalls.blogspot.com

Depreciation Rates For Vehicles As Per Tax Tax Walls, The niti aayog recommendation will help commercial vehicle operators to ply more evs for greater tax benefits.it will help push faster adoption of evs and generate. On electric automobiles and suvs, maharashtra offers a maximum subsidy of rs 2.5 lakh, while delhi, gujarat, assam, bihar, and west bengal offer maximum.

Source: www.researchgate.net

Source: www.researchgate.net

Battery electric vehicle (BEV) value depreciation by the model compared, The percentage it was used for business is 60%. For tax years beginning in 2023, the maximum section 179 expense deduction is $1,160,000.

Source: taxwalls.blogspot.com

Source: taxwalls.blogspot.com

Depreciation Rate Of Car As Per Tax Act Tax Walls, [1] this revenue procedure provides limitations on depreciation deductions for owners of passenger automobiles designed to be propelled primarily by electricity and built by an. For instance, the nissan leaf, one of the.

Source: howcarspecs.blogspot.com

Source: howcarspecs.blogspot.com

Electric Car Depreciation How Car Specs, Do electric vehicles experience depreciation? (1) 42 [in respect of depreciation of— (i) buildings 43, machinery 43, plant or furniture, being tangible assets;

The 2024 Electric Vehicle Tax Credit Has Been Expanded And Modified.

The percentage it was used for business is 60%.

For Instance, The Nissan Leaf, One Of The.

According to this section, if you buy an electric vehicle,.